It is no surprise how Mother Nature is trying to tell us something for the better part of the century. As the heat rises in many ways, climate change summits and agreements have become the new normal. The shared nature of the threat also highlights the need for closer and more widespread international cooperation to preserve the habitat in which human life has thrived. Given the far-reaching implications of climate change, an open question arises on finding ways to combat the outcomes of climate change and restore the balance.

The IPCC’s AR6[1] makes it clear that the risks of procrastination on climate change are unprecedented, and the road ahead requires corrective action plans at a scale never seen before. According to IPCC, limiting global temperature rise to 1.5 degrees C (2.7 degrees F) is still possible. The IPCC also pinpoints that the world needs to nearly halve GHG emissions by 2030 and reach net-zero CO2 emissions around mid-century while ensuring a fair and equitable transition[2]. This disclosure casts a responsibility not just on the government’s shoulders but also on private sector players, civil society, and individuals to step up and save the future we desire in sight. A narrow window of opportunity is still open, but only if we act now!

Given the potential impact of physical and transitional climate-related risks on businesses, many climate change assessments and reporting standards are increasingly codified as legal requirements under the IPCC’s vision. This presents an opportunity for businesses to amalgamate profit with environmental conscience and make it right. Subsequently, sustainability reports are becoming a staple for the business world. In the continuum, business owners are eager to explore how climate change studies can catalyze system-level changes in the face of significant global issues. This is where ESG comes into the picture, and with the right ESG practices in place, businesses can use a value-driven approach in the profit space.

| “Sustainability initiatives in companies open doors to drive better financial performance due to mediating factors such as improved risk management and advancing room for innovation.” – NYU Stern Center |

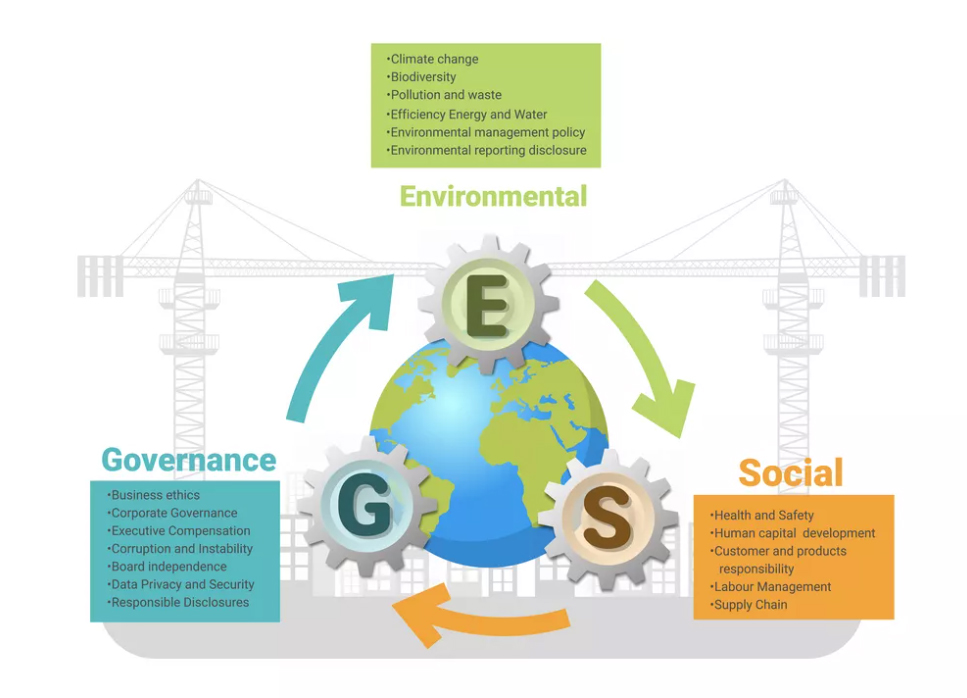

ESG simply means environment, social, and governance, which are the three pillars of this trailblazing concept. It is an investment philosophy that considers return on investment and whether the company meets social and governance responsibility standards when making decisions. It also ensures that everyone shares responsibility and accountability. Let us dive deep into the concept of ESG:

ESG criteria are standards that evaluate a company’s practices and operations, enabling socially conscious investors to identify and select sustainable investment opportunities. Environmental measures consider how a company performs as a guardian of nature. Social measures examine how it manages relations with employees, suppliers, customers, and the communities in which it operates. Governance involves a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

Notably, investments evaluated by integrating ESG criteria for a company can upsurge financial returns, while investments not considering ESG criteria may impede their returns.

Today, investors have become smart and want to invest adeptly. Investors who calculate ROIs also try to create long-term value through environmental, social, and management challenges and opportunities. In this sense, ESG factors have become a fundamental value that strengthens the reputation of a company rather than a temporary trend. Including and examining ESG criteria in the investment process allows investors to make a more comprehensive analysis by evaluating potential non-financial risks and opportunities and traditional financial analysis.

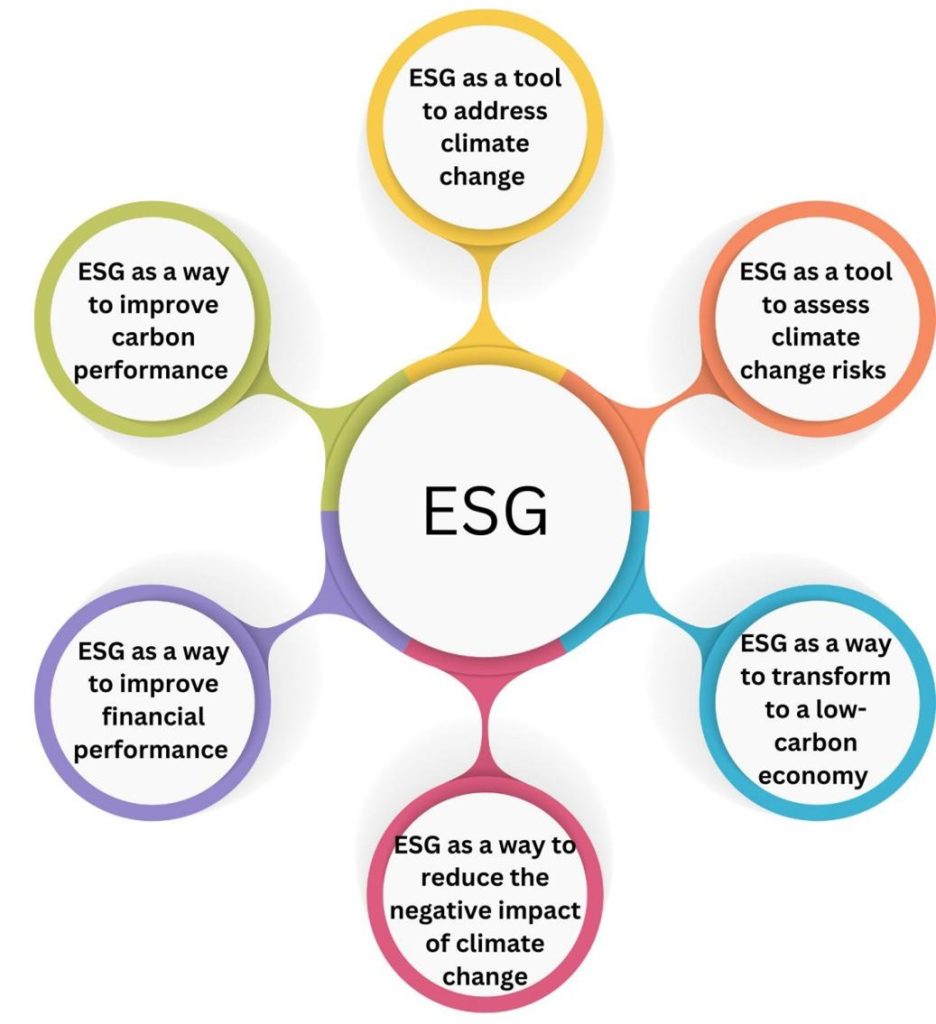

At the core of ESG investing is the basic idea that businesses are more likely to succeed and deliver robust returns if they create value for all their stakeholders– employees, customers, suppliers, and society- including the environment rather than benefiting only the company owners. Consequently, the ESG analysis examines how companies serve society and how it affects their current and future performance. The ESG analysis goes beyond what the company is currently doing. Considering future trends is critical and should intrinsically include disruptive changes that may significantly impact the future profitability of a business or its very existence. The chart below showcases how ESG combats climate change.

In the context of efforts to save humanity from the current outbreak and strengthen business resilience in the future, ESG factors have become even more critical. Let us unearth some pioneering benefits ESG practices offer:

1. Boosts financial performance: Affirmed by one of the most significant studies conducted by the Journal of Sustainable Finance & Investment, wherein over 2,000 empirical datasets were analyzed, indicating a positive response correlation between ESG practices and the financial performance of a business.

2. Ducks regulatory risks: Although voluntary in many countries, companies that ignore ESG reporting may face regulatory and legal risks in the name of fines or penalties. The European Union (EU) leads businesses to follow sustainable business practices and have the world’s most advanced ESG regulations. For example, the European Green New Deal is a comprehensive plan that aims to make Europe climate-neutral by 2050 through various measures to combat climate change.

3. Uphold’s reputation: Investors and consumers increasingly look forward to doing business with companies that prioritize ESG. According to PwC, 76% of consumers say they will stop purchasing items from companies that are derelict toward ESG policies and treat their employees, community, and environment poorly.

4. Environmental champions: Companies prioritizing ESG are more likely to operate sustainably, reduce their carbon footprint, and engage in ethical business practices.

Once again, with ESG criteria in place, it becomes apparent to determine risks and opportunities for stakeholders to make promising investment decisions. This is especially true when companies compete for capital while investors have transparency around a company’s environmental, social, and governance impacts.

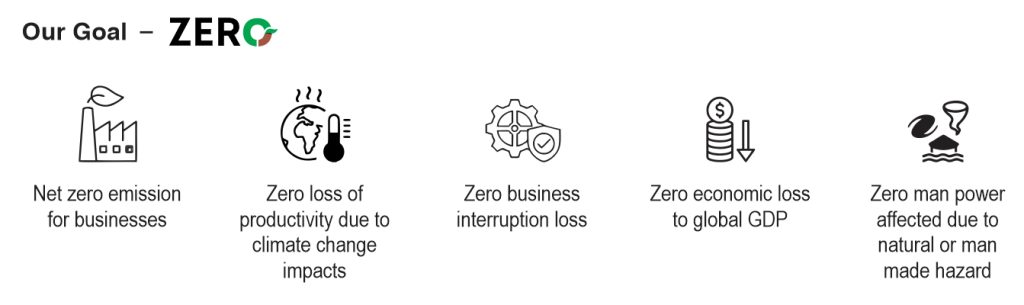

We have developed an understanding of ESG and how it will benefit a multitude of parties. However, the question remains: how will one achieve sustainability in business? At RMSI, we empower your sustainability journey by addressing key sustainability global challenges.

Our solutions help businesses integrate sustainability into every facet of their operations, fostering a future where business success and environmental impact go hand in hand. By engaging with us, businesses can adapt to mitigation measures to enhance resilience and reduce vulnerabilities, forecast workforce resilience, understand their greenhouse gas emissions, reduce their carbon footprint, and get tailored ESG consultation for statutory reporting. By engaging with us, companies can future-proof their net zero journey and demonstrate responsible business practices to their investors and stakeholders, ensuring success in addressing environmental issues.

[1] https://www.ipcc.ch/assessment-report/ar6/